Exploring the Obstacles and Answers in Modern Construction Accounting

Exploring the Obstacles and Answers in Modern Construction Accounting

Blog Article

A Comprehensive Guide to Construction Audit: Optimize Your Financial Monitoring

Reliable economic monitoring is vital in the construction sector, where the intricacies of project-based revenue and expenses can substantially affect total productivity. By employing finest practices in financial coverage and evaluation, stakeholders can not just enhance functional effectiveness however also reduce prospective threats.

Comprehending Construction Audit

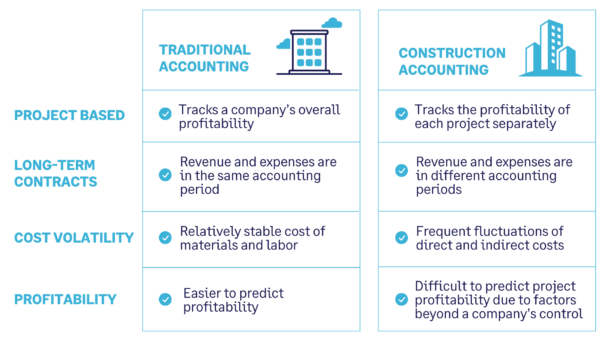

Recognizing building accountancy is important for the effective management of funds in the construction industry. This customized branch of audit addresses the one-of-a-kind obstacles encountered by building and construction companies, consisting of project-based profits acknowledgment, price tracking, and conformity with regulative requirements. Unlike standard accountancy, building accountancy requires an unique method to manage the intricacies associated with lasting contracts and fluctuating expenses.

Key components of construction bookkeeping consist of precise revenue acknowledgment, which frequently relies on the percentage-of-completion method or completed-contract technique, depending on the task's nature. This guarantees that monetary declarations mirror true performance and success gradually. In addition, task costing plays an essential function, allowing firms to track expenditures related to certain jobs, which assists in establishing profitability and resource appropriation.

One more essential facet is the administration of capital, which is usually impacted by payment timetables and delays in receivables. Effective capital monitoring makes sure that construction companies can meet functional needs and invest in future tasks. Ultimately, understanding building and construction accountancy furnishes companies with the tools needed to make educated monetary decisions, minimize risks, and boost total functional performance in a competitive sector.

Job Costing and Budgeting

Task costing and budgeting are important elements of building and construction audit that make it possible for companies to efficiently handle job financial resources and make sure productivity. Job costing includes the meticulous monitoring of all expenses connected with a details task, including labor, materials, tools, and expenses. This procedure permits building business to establish truth expense of finishing a task, helping with educated decision-making and boosting financial responsibility.

Budgeting, on the various other hand, acts as a financial roadmap for jobs. It includes setting economic restrictions and designating resources to various job elements, thereby establishing a structure against which real prices can be determined. Efficient budgeting needs extensive analysis and forecasting, taking into factor to consider historic data, market fads, and possible risks.

Together, task costing and budgeting supply the required devices for construction companies to keep an eye on economic efficiency, identify variances, and change methods as required - construction accounting. By implementing robust work costing practices and adhering to well-structured budgets, business can boost their operational effectiveness, mitigate monetary risks, and ultimately enhance their earnings in a competitive marketplace. Hence, these methods are crucial for sustaining lasting success within the building and construction industry

Monitoring Expenditures and Revenue

Accurately informative post tracking expenditures and earnings is crucial for building companies to keep financial health and make certain job stability. Effective tracking permits services to check task efficiency, determine price overruns, and make educated financial wikipedia reference choices. Executing a systematic approach to recording all economic purchases is important to achieving this goal.

Using construction bookkeeping software application can significantly improve the monitoring procedure. These tools assist in real-time monitoring of expenses, consisting of labor, materials, and subcontractor costs, while also capturing revenue produced from job turning points and customer repayments. By classifying costs and revenue streams, firms can acquire understandings into success and capital.

Financial Reporting and Evaluation

Monetary reporting and analysis play a pivotal duty in the construction industry, providing stakeholders with necessary insights into a company's financial performance and functional effectiveness. Precise economic reports, consisting of balance sheets, earnings declarations, and capital declarations, are basic for analyzing the health and wellness of a building company. These papers aid recognize fads, review job productivity, and promote notified decision-making.

In building and construction accounting, financial evaluation goes past simple coverage; it entails inspecting economic data to uncover underlying patterns and anomalies. Key efficiency signs (KPIs), such as gross earnings margins, project completion rates, and return on financial investment, offer as standards to gauge functional success. On a regular basis analyzing these metrics allows firms to identify locations requiring improvement, enhance source allotment, and enhance job administration strategies.

In addition, effective monetary reporting promotes openness and develops trust with stakeholders, consisting of clients, suppliers, and financiers - construction accounting. By keeping rigorous monetary oversight, construction companies can reduce dangers, guarantee conformity with regulatory needs, and eventually drive sustainable growth. Therefore, a robust monetary coverage and analysis framework is essential for navigating the intricacies of the construction landscape and achieving long-lasting success

Best Practices for Success

To achieve success in building accountancy, business must embrace a set of ideal practices that improve operations and improve economic administration. Implementing a robust job administration software application customized for building can assist in real-time tracking of job costs and budgets, allowing for more accurate projecting and resource allotment.

2nd, adopting a regular strategy to work setting you back is vital. This includes carefully tracking view it now all expenses connected with each job, including labor, products, and expenses. Routinely reviewing task costs versus initial price quotes assists recognize variations early, making it possible for timely rehabilitative actions.

Third, keeping extensive documentation techniques makes certain compliance with guidelines and streamlines audits. This consists of keeping comprehensive records of agreements, adjustment orders, billings, and receipts.

Additionally, investing in team training is crucial. Making sure that employees are fluent in accounting principles, software application usage, and industry requirements can dramatically enhance efficiency and precision in financial reporting.

Conclusion

Report this page